The Financing Landscape For Startups and Early-Stage Companies Today

Posted by Robert Norton on

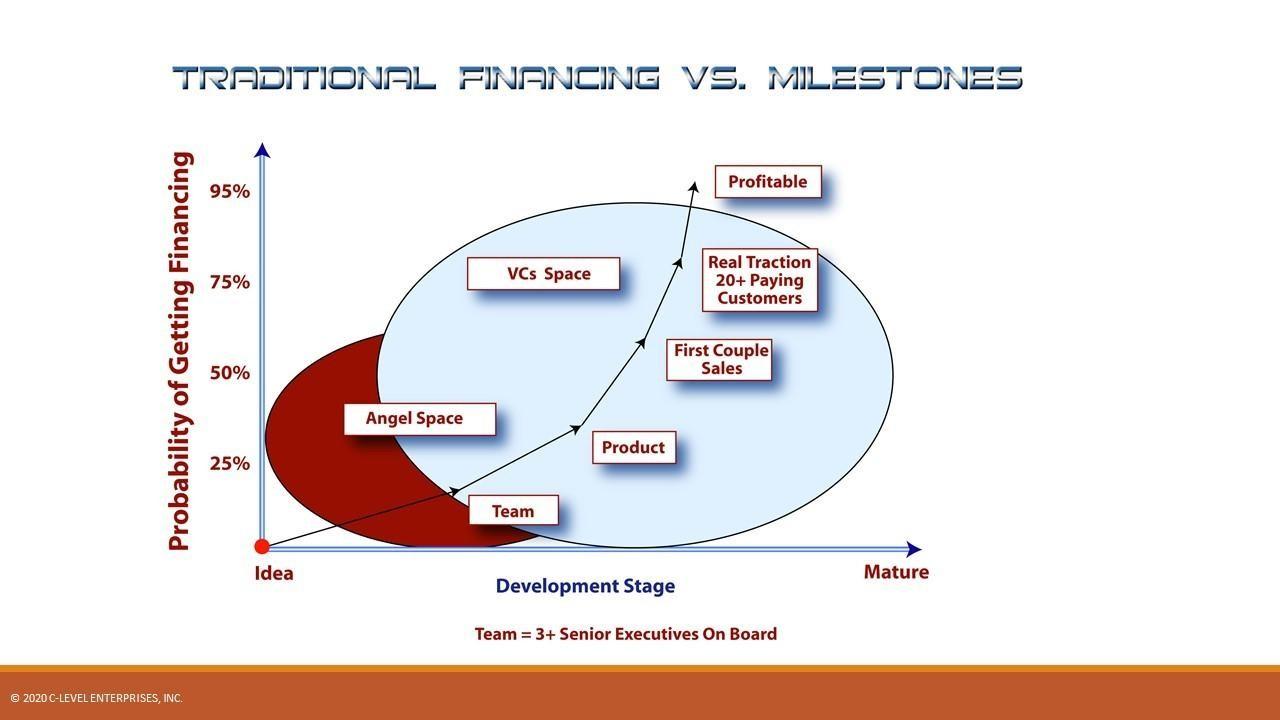

We are back to looking like the early 1990s again as everyone has "moved up the food chain" one to two levels. True Series A financings with money designed to develop the product are rare today and most first institutional investments are in companies with proven "traction", this means lots of sales completed. In the past, there were usually two rounds of financing before this was required, one to develop the product and another to accomplish the first several sales by testing the sales and marketing processes. This means you need to get much further on much less money. This can mean adding a service component to your market entry strategy, corporate partners or many other strategies, but unfortunately it will mean certain death for the majority of first-time entrepreneurs who do not have a well formulated and proven financing strategy and plan.

Luckily, software development, hardware development and some other things have gotten more efficient. Lots of phone apps can even be developed for less than $20,000. Of course, products that require real research and development can cost far more. Typically, an MVP, or Minimum Viable Product, approach must be taken. However, if you can do it so can someone else, so the barrier to entry is not very high when it is so easy to develop a product.

Companies literally need to design their business plans around these conditions, or risk failure. There are many ways to tune your launch strategy to require much less capital. Today, you need to get to a breakeven level faster, and certain milestones must be met at the right time. Early-stage capital is much harder to get, may cost equity or even be completely unavailable for certain stage companies, creating a huge gap for what used to be expansion financing in Series B, C and D rounds. Of course, once a profitable formula is proven it gets much easier to raise larger sums of money, making the seed and Series A certainly the hardest money to raise. And, of course, your valuation is so low at that point it will be the largest chunk of equity you will need to give up if you need capital to achieve your plan. Many companies will fall into this chasm if they do not plan well in advance. You require a capital raising plan for the next two years at all times, which includes multiple steps/rounds.

If your company is a picnic, then the financing environment is the weather. You can not change it! You need to adjust your plans to it -- before you head out! Understand this because may great companies and ideas will fail only because they have an unachievable capital path in today's environment.

The Traditional Financing Lifecycle

A different world where lots of good companies will fall into the precipice that used to be the "Series A to Series B stage" financings in the $1.5MM to $5MM area that angels cannot usually do and VC are not doing much of today. However, angel syndicates have filled this gap, at least up to $2M and super angels that can invest $500K to $5M each cover some of the area VCs use to fill.

Bottom Line: You NEED to adjust your business plan in

major ways to account for many factors! And it will be very dependent on the short-term environment. Timing is important.

A real financing strategy maps out three to five year of financing in a plan showing major milestone achievements, and how they may increase the valuation of the company and make the further rounds all easier. This is built into a 5-year simulator spreadsheet. Not just a pro forma that most accounting people do for running what if scenarios and tuning your capital raising plans.

A financing strategy is something that takes experience and an understanding of the current financing landscape. It is best to get a professional involved to develop this. However, many professional only specialize in certain financing sources and stages. As of about 2019 crowdfunding has emerged as a source of funding for many early-stage companies. We have courses and webinars with more in depth information on raising financing, as it is a big area with dozens of sources.

|

Learn more about our Growth and Scaling (GSP) |

|

For a free video consultation call on what your |

Mr. Norton offers a flat rate consultation session on financing to help young companies identify what they don't know yet and get their company ready. Most young companies jump in much too early, ruining their chances with the first contacts. Not only is this a waste of time and effort, but it shuts down your best contacts early and prevents you from getting to other investors those would refer you to.

The most common mistake entrepreneurs make raising angel money today is going out to their best networking contacts before they are ready. They burn their best chances for money and other contacts in the chain.

Join the course How to Raise Millions from Outside Investors

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has trained, coached and advised over 1,000 CEOs since 2002. And is Founder of The CEO Boot Camp™ and Entrepreneurship University™. Mr. Norton works with companies to triple their chances of success in launching new companies and products. And helps established companies scale faster using the six AirTight Management™ systems. And helps companies successfully raise capital.

What can we help you with today? Scaling, training, consulting, coaching?

Call (619) SCALE06 or (619) 722-5306 9am-6pm CT

Or Schedule a free 30-minute strategy session by clicking here.