How big are typical venture capital investment valuations at each stage of development?? Series A, Series B, and Series C?

Posted by Robert Norton on

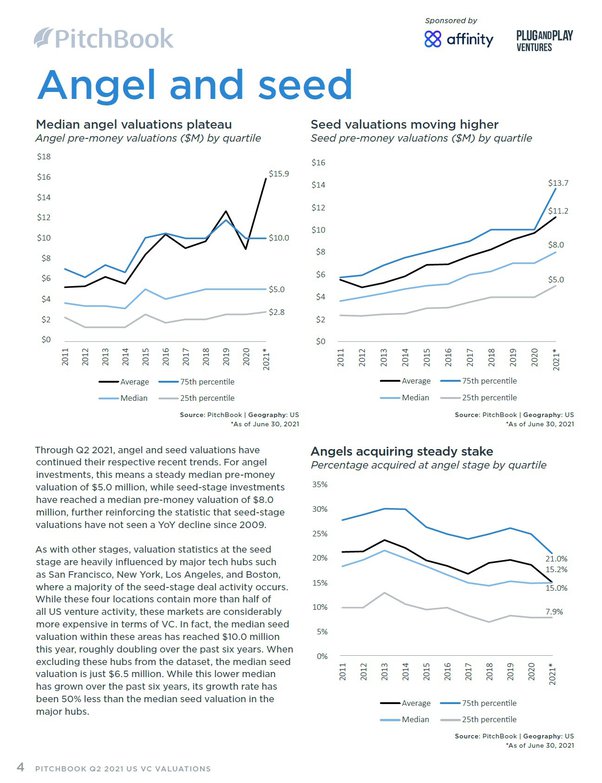

This is best answered by this diagram of statistical information. However, be aware these are the deals that report only and not all deals and so likely higher than the true averages because smaller angel deals are less likely to report to PitchBook.

|

Learn more about our Growth and Scaling (GSP) |

|

For a free video consultation call on what your |

I would guess these valuations are doubled by missing so many of the smaller, seed deals that go unreported. Many companies start with a single $50K to $100K angel which is enough to get a product finished after the founder’s invest sweat equity and some of their own capital while bootstrapping.

Click here to get this Financial Package

How to Raise Millions for Any Company - Online Video Course

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has trained, coached and advised over 1,000 CEOs since 2002. And is Founder of The CEO Boot Camp™ and Entrepreneurship University™. Mr. Norton works with companies to triple their chances of success in launching new companies and products. And helps established companies scale faster using the six AirTight Management™ systems. And helps companies successfully raise capital.

Call (619) SCALE06 or email info@AirTightMgt.com for a complementary strategic consultation.

Share this post

- 0 comments

- Tags: Financing