What is the difference between growth and scaling?

Posted by Robert Norton on

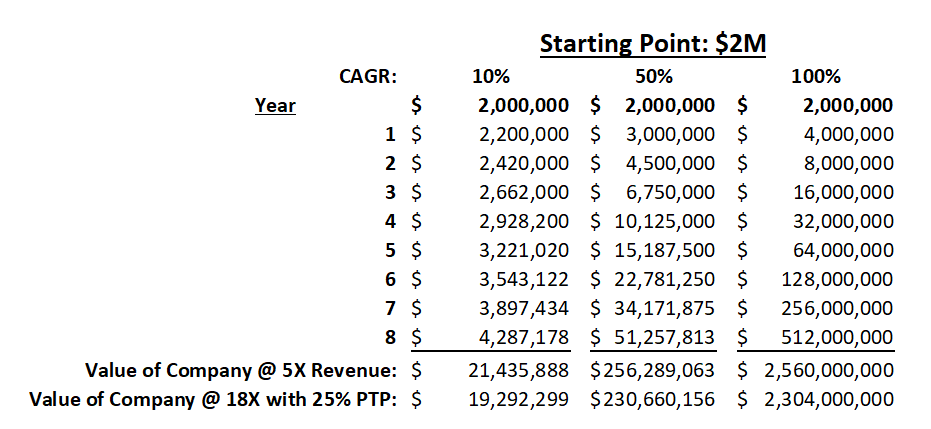

Well, although this is not officially defined by anyone, growth is literally any growth at all. We define scaling as the kind of growth that venture capitalists seek for high returns on their investments, which means fifty-percent compound annual growth rate (CAGR). Typically, the math of this, which is reaching $100 million in sales in about five years, means a company will need at least 50% annual growth, and maybe 100%. Here is a table that shows this kind of growth and reveals that massive compounding factor of this kind of growth. And explains why venture capital must seek large opportunities to pay high yields on capital invested, which can only come from strong growth.

What this math says clearly is that a company that grows at 100% per year will be worth one hundred and twenty-one times more than a company that grows at 10% per year after eight years. This is what creates real wealth when compounded, and what venture capitalists seek. The truth is even those that receive many, many millions of investments from VCs only about ten to fifteen percent of them will ever reach this kind of sustained growth and have a big exit. Most of the venture fund’s returns will be paid by these few companies while others will become “the living dead”, going sideways and never offering a good exit, or they will close down because they never reach a good product-market fit with all the financial returns that entails. Some will be sold at enough profit to return the investment of more, too.

This kind of more rapid growth (scalability) attracts capital, but it will also help recruit top employees at all levels because those employees will have financial opportunities via stock options and also career growth opportunities as the company grows that can get them rapid promotions and increases in responsibility. This is why big visions and markets can become a self-fulfilling prophecy because the most important resource is finding the best people and when you can offer both financial and career upside to people you will successfully recruit the best people.

Also check out my blog where I have loads of articles on entrepreneurship, scaling and raising capital.

Click here to visit my Blog

Another way to answer the above questions is that the ability to scale rapidly is what allows a company to attract large amounts of capital, which “normal” growth will not. This is why VCs are always looking for “scalable” companies. This means they must have large markets, strong management teams to staff and run the company, and barriers to entry that will protect their margins from a hundred competitors doing the same things.

|

Learn more about our Growth and Scaling (GSP) |

|

For a free video consultation call on what your |

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has trained, coached and advised over 1,000 CEOs since 2002. And is Founder of The CEO Boot Camp™ and Entrepreneurship University™. Mr. Norton works with companies to triple their chances of success in launching new companies and products. And helps established companies scale faster using the six AirTight Management™ systems. And helps companies successfully raise capital.

Call (619) SCALE06 or email info@AirTightMgt.com for a complementary strategic consultation

Share this post

- 0 comments

- Tags: Expansion - Growth, Scaling